EIDL Opportunity to be Released by SBA

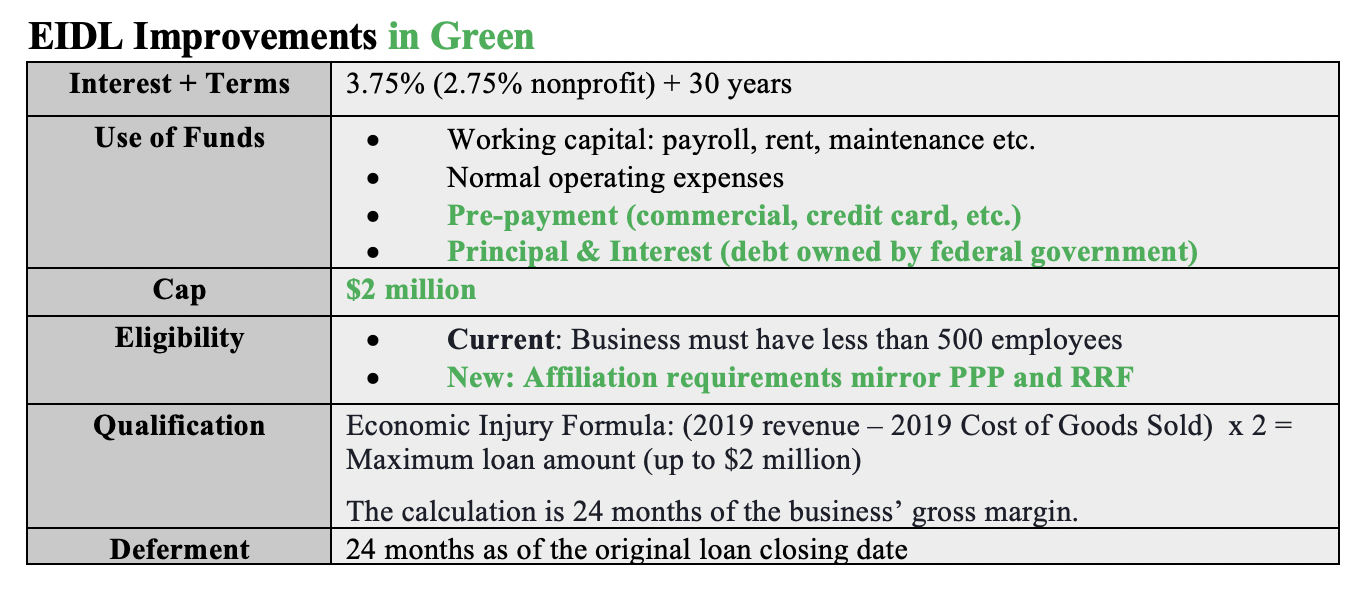

This week, the National Restaurant Association urged the U.S. Small Business Administration (SBA) to release plans improving the Economic Injury Disaster Loan (EIDL) program. These changes include raising the EIDL cap amount to $2 million and ensuring affiliation rules are aligned with PPP so that multi-unit operators can access relief.

Restaurants – along with the American Hotel & Lodging Association, Asian American Hotel Owners Association, International Franchise Association, Coalition of Franchisee Associations, and the Global Health & Fitness Association – are requesting SBA share information regarding the timeline for these much-needed improvements. The industry letter to SBA can be read here.

What does this mean for restaurants?

More restaurants will qualify for the EIDL program and restaurants can receive higher EIDL amounts. This is a flexible source of working capital that can be used to offset previous commercial/private debt that may have more challenging rates or terms.

What does this not mean for restaurants?

This is not for a business to use as startup capital, and is intended to help a business recover. EIDL is generally for businesses in operation as of 2019. There is not a “forgiveness” formula for these loans like the Paycheck Protection Program (PPP).

If a restaurant has already applied and want to request an increase:

- Sign into portal & request an increase.

- Sign & submit the 4506T (match the 2019 address used in IRS filings).

- Respond to SBA email asking for loan increase amount.

If the restaurant is a brand-new applicant:

- Visit SBA’s COVID EIDL website when the updates are posted.

- Prepare your business info, owner info, and bank information.

To learn more, access a recorded webinar from the Association or access the SBA’s FAQ on EIDL.